Entrepreneurs’ Organization Baltimore Honored with Maryland Inno Fire Awards 2024

We are thrilled to announce that Entrepreneurs’ Organization Baltimore (EO Baltimore) has been honored with the prestigious Maryland Inno Fire Awards 2024. This recognition highlights the remarkable strides EO Baltimore has made in expanding its accelerator program and fostering entrepreneurship in the region.

Growth and Impact of EO Baltimore’s Accelerator Program

Our accelerator program (EOA) has been a cornerstone of EO Baltimore’s mission to support small business owners. Since its inception, the program has seen remarkable growth—from just three participants in 2020 to 14 participants in 2024. This increase highlights the program’s popularity and effectiveness in aiding early-stage businesses with revenues between $250,000 and $1M annually.

The EOA provides essential guidance, mentorship, and resources to help small business owners scale their operations and achieve their growth objectives. Participants in the program benefit from a structured curriculum, peer-to-peer learning, and access to a network of experienced entrepreneurs and business leaders.

Key Highlights:

Leadership and Expansion: Under the dynamic leadership of Michael Raphael, EOA’s Chair, we are planning to nearly double the size of the accelerator program. This expansion will enable us to offer critical support to more local entrepreneurs, helping them navigate the challenges of scaling their businesses.

Scholarship Initiative: To enhance accessibility, we are launching a new scholarship initiative this month. The scholarship will cover approximately $500 of the $2,700 annual membership cost, making it easier for more entrepreneurs to benefit from the program. This initiative is part of our commitment to making entrepreneurial support accessible to a broader audience.

New Clubhouse: Our new 1,700-square-foot clubhouse at 1909 Thames St. will serve as a central hub for entrepreneurial activity. This state-of-the-art venue will host events, panel discussions, and workshops, fostering a vibrant community of entrepreneurs and providing a space for collaboration and innovation.

Leadership and Vision

Shannon Roberts, President of EO Baltimore and founder of the marketing firm Brand Builders, continues to drive our chapter’s growth and influence. Her vision and dedication are instrumental in our ongoing efforts to innovate and expand our impact in the region. Under her leadership, EO Baltimore has introduced several initiatives aimed at enhancing member engagement and providing valuable resources to local entrepreneurs.

Recognition in the “Ecosystem Builders” Category

Winning the Fire Awards in the “Ecosystem Builders” category is a testament to EO Baltimore’s role in fostering a supportive environment for entrepreneurs. This accolade from Maryland Inno and the Baltimore Business Journal not only acknowledges our past achievements but also positions us as a key player in shaping the future of entrepreneurship in Maryland.

One measure of success for our Accelerator program is the number of graduates into our EO chapter as full-fledged members above the $1M revenue level. The learning and support we provide help our business owner participants grow their businesses to the next level.

—Michael Raphael, Accelerator Chair, EO Baltimore | Founder and CEO of Direct Dimensions, Inc.

This award highlights our commitment to building a robust entrepreneurial ecosystem in Baltimore. It recognizes our efforts in creating programs and initiatives that provide entrepreneurs with the tools, knowledge, and support they need to succeed.

Community Engagement and Future Plans

EO Baltimore is not just about supporting existing entrepreneurs; we are deeply invested in cultivating the next generation of business leaders. Our initiatives extend beyond the accelerator program to include educational workshops, networking events, and community outreach programs designed to inspire and equip aspiring entrepreneurs.

Looking ahead, EO Baltimore plans to continue its expansion efforts, with new programs and initiatives on the horizon. We are committed to leveraging our resources and network to drive economic growth and innovation in the Baltimore area.

How Baltimore’s History and Culture Influence Its Business Environment

Baltimore, Maryland is a city steeped in history and rich with culture. Its past and present contribute to a unique business landscape that fosters creativity and entrepreneurship. Today, let’s explore the elements of Baltimore's history and culture that have shaped its business environment and fostered a thriving entrepreneurial ecosystem.

A Brief History of Baltimore, Maryland

Founded in 1729, Baltimore has a storied past that has played a significant role in shaping the United States. The city's location on the Patapsco River made it a major port and center for trade and manufacturing during the 19th century. Baltimore also played a pivotal role in the War of 1812, with the successful defense of Fort McHenry inspiring the creation of the Star-Spangled Banner, our national anthem.

The city has a history of innovation, too, as the birthplace of the first American railroad, the Baltimore and Ohio Railroad, which began operation in 1830. This spirit of innovation continues to thrive in Baltimore today.

Baltimore’s Vibrant Culture

Baltimore's culture is diverse and dynamic, with a rich arts scene, a mix of architectural styles, and a culinary heritage that blends local seafood and international influences. The city is home to several world-class museums, such as the Walters Art Museum and the Baltimore Museum of Art, as well as performing arts venues like the Hippodrome Theatre. Baltimore's famous Inner Harbor area offers a bustling waterfront with shops, restaurants, and entertainment options, reflecting the city's ongoing commitment to revitalization and growth.

How History and Culture Influence Baltimore’s Business Environment

Baltimore's history and culture create a unique environment for businesses and entrepreneurs. The city's legacy of innovation, combined with its diverse cultural influences, has fostered an entrepreneurial spirit that continues to thrive. There is also a wealth of diversity in the Baltimore economy itself. Industries in Baltimore range from cybersecurity to life sciences, manufacturing, and information technology. This leads to an inclusive business environment that welcomes innovation across multiple sectors.

Baltimore's businesses also benefit from support from institutions and organizations—like Innovation Works and Entrepreneurs’ Organization (EO) Baltimore—which aim to cultivate and grow local businesses. The city's educational institutions, such as Johns Hopkins University and the University of Maryland, Baltimore County, also contribute to this thriving business environment by producing a highly skilled workforce and driving research and development.

Baltimore's entrepreneurial spirit is fueled by its influential past and cultural impact, making it an ideal place for businesses—and business owners—to grow and prosper. If you’re an entrepreneur looking to expand your opportunities in the Baltimore area, we’re here to help!

Here at Entrepreneurs’ Organization (EO) Baltimore, we’re Maryland’s most influential business network, run by entrepreneurs for entrepreneurs. At its core, EO Baltimore is a collection of like-minded entrepreneurs focused on business growth, personal development, and community engagement. Join today to learn and grow through peer-to-peer learning, expert connections, and once-in-a-lifetime experiences!

How To Build Your Business Network

As an entrepreneur, building a strong business network is essential for the growth and success of your company. Here’s a closer look at the importance of networking in business, and how you can build your network for entrepreneurial success.

The Importance of Networking

Building a professional network comes with lots of advantages—for you, your business, and your overall entrepreneurial career. The many benefits of networking include:

Expanding your business opportunities: A diverse network provides you with access to new clients, partners, and investors, helping you find opportunities to grow.

Enhancing your knowledge: Networking exposes you to different industries and business models, allowing you to learn from others' experiences and apply these insights to your own pursuits.

Increasing your visibility: Attending networking events and being active on professional platforms can raise your company's profile, making it easier for potential clients and partners to find you.

Building relationships: Establishing strong relationships within your network can lead to valuable long-term collaborations and mutually beneficial partnerships.

Access to resources: Networking can connect you with people who can provide key resources like mentorship, expertise, or introductions to important players in your field.

Networking Tips for Entrepreneurs

Here are our best tips for how to build your network:

Set clear goals: Before attending a networking event or joining a professional platform, define your objectives. This will help you focus on meeting the right people and maximizing the value of your networking efforts.

Attend industry events: Participate in conferences, workshops, and seminars related to your field. These events provide excellent opportunities to meet like-minded individuals, potential clients, and industry experts. You can use resources like Eventbrite and Meetup to find events near you.

Leverage social media: Use platforms like LinkedIn and Twitter to connect with professionals in your industry. Share relevant content, engage in conversations, and demonstrate your expertise.

Nurture relationships: Building a strong business network takes time and effort. Keep in touch with your contacts, offer assistance when appropriate, and stay open to opportunities for collaboration.

Join professional organizations: Joining groups like Entrepreneurs' Organization (EO) Baltimore can help you connect with peers, access resources, and stay informed about industry trends.

Be authentic: Authenticity goes a long way in building lasting relationships. Be genuine in your interactions and maintain a consistent personal brand across all networking platforms.

By following these tips and staying committed to building your business network, you'll be on your way to creating a strong foundation for the success of your entrepreneurial endeavors. If you’re ready to level up your professional network, we’re here to help!

Here at Entrepreneurs’ Organization (EO) Baltimore, we’re Maryland’s most influential business network, run by entrepreneurs for entrepreneurs.

At its core, EO Baltimore is a collection of like-minded entrepreneurs focused on business growth, personal development, and community engagement.

Join today to learn and grow through peer-to-peer learning, expert connections, and once-in-a-lifetime experiences!

The Importance of Mentorship in Business

In the world of business and entrepreneurship, mentors play a vital role in shaping the success of aspiring entrepreneurs. A mentor can provide guidance, support, and wisdom that can help a mentee navigate the challenges of starting and growing a business. Here’s why business mentorship is so important, what good mentors have in common, and where you can look for a mentor to help you.

Why Mentorship Is Important

The mentor-mentee relationship is incredibly rewarding and brings benefits to both parties. Mentors often learn about themselves while teaching others, and develop fulfilling professional relationships with their mentees. Meanwhile, mentees get to benefit from the wisdom and experience of their mentors.

A good mentor can offer valuable insights based on their own experiences. They can share their successes and failures, which can help a mentee avoid common mistakes and pitfalls. An entrepreneur mentor can also provide practical advice on everything from developing a business plan to managing finances and building a team. The mentor's expertise can be invaluable to an entrepreneur who is just starting out, providing a roadmap for success and helping them make the most of their resources.

Another major aspect of the importance of coaching and mentoring is social and emotional support. Starting a business can be a lonely and stressful journey, and having someone to talk to who understands the struggles and challenges can be extremely beneficial. Mentors can offer encouragement and motivation, helping a mentee stay focused and driven.

What Makes a Good Mentor?

Mentors are all different and unique people, and mentees will have their own specific needs and goals, so no mentor-mentee relationship will look the same. However, there are some common qualities that good mentors share. Look for mentors who are:

Experienced in your industry or field

Approachable and willing to listen

Patient and empathetic, willing to help you work through challenges

Honest and direct, providing constructive feedback

Committed to the relationship and willing to invest time and energy into the mentorship

How To Find a Mentor

Finding a good business mentor starts with networking. Attend industry events and conferences (in person or online), and seek out professionals who have experience and knowledge in your field. You can also seek out business mentorship programs. Lastly, consider reaching out to former professors, colleagues, or friends who have experience in your field and may be willing to offer guidance and support.

Mentorship is a vital part of business and entrepreneurship, and can help you develop the social support you’ll need to succeed. If you’re ready to expand your professional relationships, we’re here to help!

Here at Entrepreneurs’ Organization (EO) Baltimore, we’re Maryland’s most influential business network, run by entrepreneurs for entrepreneurs. At its core, EO Baltimore is a collection of like-minded entrepreneurs focused on business growth, personal development, and community engagement. Join today to learn and grow through peer-to-peer learning, expert connections, and once-in-a-lifetime experiences!

Finding Work-Life Balance as an Entrepreneur

For entrepreneurs, maintaining a healthy work-life balance can be a difficult task. But even when your business is an integral part of your life, it’s essential to find that balance. Being able to physically and mentally step away from work will help you have a more satisfying personal life, and will allow you to be more focused and revitalized when you return.

Here’s why having a good work-life balance is so important, and what steps you can take to improve that sometimes shaky balance.

The Importance of Work-Life Balance

A healthy work-life balance means you can fulfill your work responsibilities while also having time for personal pursuits, such as hobbies, exercise, socializing, and relaxation. Being able to cultivate that work and life balance will allow you to enjoy both your work and your personal life on a richer level.

Developing a good work-life balance has many benefits and can help you:

Reduce stress and burnout

Increase productivity

Improve relationships

How To Have a Work-Life Balance

Here are some of our best work-life balance tips to help you establish a better work-life balance:

Set boundaries: This can be especially difficult for entrepreneurs, and it’s a crucial step for that reason. Setting clear boundaries between work and personal time can help you get out of work mode and allow you to enjoy your free time without being bogged down by work worries. You can try things like not checking work emails outside of work hours or blocking off time for personal pursuits.

Be social: Humans are social creatures. Take time to make social connections with fellow entrepreneurs and new friends, and spend quality time with your loved ones.

Take breaks: Take regular breaks throughout the day to stretch, move around, and recharge. This can help you stay energized and focused.

Be comfortable saying no: Take care of yourself by deciding not to pursue extra work or commitments that can interfere with your personal time. Avoid overworking and remember to guard your personal time and mental health.

Practice self-care: Take care of your physical and mental health by exercising, eating healthy, getting enough sleep, and engaging in relaxing activities like meditation or yoga.

It’s also important to periodically evaluate and refine your work-life balance. Rather than feeling good about your work-life balance and then letting it slide, you should check in with yourself regularly to see how you’re doing. Remember that a healthy work-life balance isn’t a one-time achievement, but a rolling goal for your life.

Here at Entrepreneurs’ Organization (EO) Baltimore, we’re Maryland’s most influential business network, run by entrepreneurs for entrepreneurs. At its core, EO Baltimore is a collection of like-minded entrepreneurs focused on business growth, personal development, and community engagement. Join today to learn and grow through peer-to-peer learning, expert connections, and once-in-a-lifetime experiences!

Improving Productivity and Promoting Good Habits for Entrepreneurs

As an entrepreneur, you’ve probably got a lot on your plate. From day-to-day business tasks to building connections with others, there’s no shortage of work to be done. Thankfully, though, you can improve your productivity and develop some productive habits to help you get more done in less time! Read on to find out how you can best seize the day.

How To Be More Productive at Work

Ready to work smarter, not harder? Here are some productivity tips to help you tackle your to-do list:

Prioritize your tasks each day

Eliminate distractions

Stay organized with lists, calendars, apps, or any other productivity tools that help

Break large goals and projects down into smaller, manageable tasks

Try tools and techniques like the Pomodoro Technique to find what works for you

Take regular breaks for exercise, mindfulness, or rest

How To Form Good Habits

Habit formation is not an overnight achievement; the key to developing a new habit is consistency and repetition. After all, new habits take an average of 66 days to form. Take your time and start small. Track your progress. Incorporate positive reinforcement. Use cues and triggers to prompt your new habit, and you’ll be on your way!

Good Habits for Entrepreneurs

Now that you’re equipped to develop some new habits, it’s time to decide which habits you are going to pursue. If you already have them in mind, that’s great!

If not, here are some of the best habits for entrepreneurs to get you started:

Consistent goal-setting

Regularly establishing goals—both long-term and short-term—is key for accomplishing great things. Goals allow you to prioritize tasks, focus on what’s important, stay in the game, and always keep an eye toward improvement and growth.

Staying up-to-date on news and events in your field

Keeping up with relevant current events, research, and best practices is crucial for entrepreneurs. As an expert in your field, you should keep apprised of the latest information to ensure that you’re maintaining your expertise, demonstrating your competence, and remaining open to inspiration and innovation.

Financial management and planning

This good habit needs no explanation! Watch the way your money moves to keep yourself and your business in good financial health.

Self-care

Don’t let your own health fall by the wayside. Eat nutritious food, engage in physical activity, and get rest and relaxation when you need it.

Building networks

Developing connections with others and growing through supportive relationships is an essential part of entrepreneurship. If you’re looking to connect with a group of like-minded entrepreneurs in the Baltimore area, join Entrepreneurs’ Organization (EO) Baltimore today!

Here at EO Baltimore, we’re Maryland’s most influential business network, run by entrepreneurs for entrepreneurs. At its core, EO Baltimore is a collection of like-minded entrepreneurs focused on business growth, personal development, and community engagement. Join today to learn and grow through peer-to-peer learning, expert connections, and once-in-a-lifetime experiences!

How To Find Motivation and Inspiration as an Entrepreneur

When the work days drag on and the coffee isn’t helping, you might be in need of a good dose of motivation and inspiration. Here are our best tips for how to build motivation and how to be inspired when you need it.

How To Get Motivated

Work motivation can sometimes be a challenge, no matter how much you enjoy what you do. Thankfully, there are many strategies that can help reinvigorate your passion and drive. Try the following methods to motivate yourself, or to find out how to motivate employees.

Look ahead. Set clear and achievable goals for your long-term future, or if you have them already, take a minute to review your plans. This can give you a sense of direction and purpose in your work. It can also spark excitement about where you’re headed and all the possibilities the future holds.

Remember your “why.” Why did you get into entrepreneurship? Why are you doing this work? Keep your answers to these questions close. You have your own reasons, passions, and interests, so don’t forget them. Lean in.

Treat yourself (and others). Create a positive work environment by surrounding yourself with supportive colleagues, engaging in regular self-care, and recognizing and celebrating your accomplishments. Maintaining an atmosphere of positivity and encouragement is a great way to stay motivated.

Get personal. Take a look at how your work is impacting your life, the lives of others, your community, or the world around you. You’re making a difference. That’s powerful motivation for entrepreneurs, so use it!

Remember, motivation is a dynamic and constantly evolving state, so be open to experimenting with different techniques until you find what works best for you.

How To Find Inspiration

Inspiration for entrepreneurs can come from many sources, both internal and external. Here’s a helpful round-up of the things you can do to find some work inspiration.

Spend some time in nature. Take a walk in a park, observe the changing seasons, or watch the stars at night. Spending time in nature has been shown to boost mood, increase creativity, and relieve stress.

Consume stories. Inspiration can also be found in books, movies, and other forms of media. You can also talk to friends, family, and colleagues to gain new perspectives and spark creative ideas. Stay up-to-date on news and events in your field, too, as a way to stay informed and seek innovative ideas.

Be mindful. Finally, inspiration can come from within, through mindfulness, meditation, or simply taking the time to reflect on your thoughts and emotions. Inspiration is everywhere, so keep your mind open and be receptive to new ideas and experiences.

Here at EO Baltimore, we’re Maryland’s most influential business network, run by entrepreneurs for entrepreneurs. At its core, EO Baltimore is a collection of like-minded entrepreneurs focused on business growth, personal development, and community engagement. Join today to learn and grow through peer-to-peer learning, expert connections, and once-in-a-lifetime experiences!

Top Social Skills for Entrepreneurs

Why Are Social Skills Important in Business?

Social skills are essential for success in the business world. They help entrepreneurs and professionals to build relationships, communicate effectively, and navigate complex social situations. Research has shown that entrepreneurs with strong social skills are more likely to be successful than those with weaker social skills. This is because social skills help entrepreneurs build relationships with investors and secure partnerships and collaborations.

Strong social skills are also extremely beneficial for collaboration with your team itself. When you increase your social competence, you can more effectively communicate with employees, build trust and strong relationships, and lead by example. A study in the Harvard Business Review honed in on the top five key traits of successful entrepreneurs, and three of the five were rooted in social skills: persuasion, leadership, and interpersonal skills.

The social skills that will help you achieve entrepreneurial success include:

Good communication

Active listening

Networking

Negotiation

Teamwork

Conflict resolution

Cultural competence

Entrepreneurs should also develop their emotional intelligence. Emotional intelligence refers to “the ability to understand and manage your own emotions, as well as recognize and influence the emotions of those around you.” Emotionally intelligent entrepreneurs are better able to manage teams, lead effectively, and run their businesses with minimal drama and maximal thoughtful strategy.

How To Develop Social Skills

Given the importance of social skills, how can we work at developing them in order to improve our entrepreneurial skill set? There are many ways to approach this, and they all require practice. Pay attention to yourself and others as you work to sharpen your skills. You can try:

Practicing active listening by paying attention to what others are saying and responding in a thoughtful and appropriate manner

Working on your communication skills, including your body language, tone of voice, and word choice

Attending networking events and professional development workshops or joining a business network

Volunteering for projects or initiatives that will help you build connections and gain social experience

Reflecting on your interactions, seeking feedback, and adapting your behavior accordingly

Developing social skills in business takes time and effort, but it can ultimately lead to more successful and fulfilling professional relationships. And if you’re ready to expand those professional relationships further, we’re here to help you grow!

Here at Entrepreneurs’ Organization (EO) Baltimore, we’re Maryland’s most influential business network, run by entrepreneurs for entrepreneurs. At its core, EO Baltimore is a collection of like-minded entrepreneurs focused on business growth, personal development, and community engagement. Join today to learn and grow through peer-to-peer learning, expert connections, and once-in-a-lifetime experiences!

The Power of Introverts in Entrepreneurship

Life and work, especially for entrepreneurs, require a lot of passion and energy. But how do you recharge that energy when you start to run dry? While extroverts gain energy from social activity, introverts find their energy elsewhere: in quiet solitude and private contemplation. Because of this, many introverts prefer seclusion and calm environments, and their natural quietness can lead to them being overlooked in a noisy world.

But in the world at large and in the realm of business, introverts have their own flavor of influence—unique strengths and leadership styles that develop deep connections and insightful strategy. Here’s a look at introverts in business, and how their reserved approach can achieve powerful returns.

Introvert Strengths

In her bestselling book, “Quiet: The Power of Introverts in a World That Can’t Stop Talking,” author Susan Cain highlights the particular strengths and skill sets of introverts. She cites research demonstrating that introverts are more likely to be creative, thoughtful, and good listeners—all valuable qualities in entrepreneurship and beyond.

Because introverts tend to be more reflective and deliberate in their decision making, their processes can lead to more thoughtful and successful business strategies. Additionally, introverts often have strong analytical skills that can promote effective problem-solving.

Acknowledging and understanding these innate strengths allow introverts to appreciate their own nature and potential. “Make no mistake. Introverts make successful entrepreneurs,” reports Forbes. “The key is to recognize that introversion is an asset, not a liability. Only then will you be able to make it your superpower.”

The Introverted Leader

In addition to their natural strengths, introverts also have different leadership styles compared to extroverts. Their focus on big-picture success, their tendency to listen to others, and their preference for deeper connection give introverted leaders an advantage in certain work environments.

“In a dynamic, unpredictable environment,” the Harvard Business Review reports, “introverts are often more effective leaders—particularly when workers are proactive, offering ideas for improving the business… Introverted leaders tend to listen more carefully and show greater receptivity to suggestions, making them more effective leaders of vocal teams.”

So, introverts—embrace your strengths as you move through the busy world of entrepreneurship. Whether your energy comes from a lively dinner party or a cozy night in, you have your own talents and your own personal paths to success.

Here at Entrepreneurs’ Organization (EO) Baltimore, we’re Maryland’s most influential business network, run by entrepreneurs for entrepreneurs. At its core, EO Baltimore is a collection of like-minded entrepreneurs focused on business growth, personal development, and community engagement. Join today to learn and grow through peer-to-peer learning, expert connections, and once-in-a-lifetime experiences!

How to Write and Deliver a Performance Review (With Example Templates)

The performance review. Dreaded equally, in some cases, by the giver and the receiver, but it doesn’t (and shouldn’t) have to be that way. If you’ve never written or delivered a performance review to an employee, or if the thought of doing a review is about as appealing as a root canal, here are a few tips to help you.

In recent years, the annual or semi-annual performance review process has come under a lot of fire. A 2018 article in Forbes magazine said they were pointless and insulting and referred to them as ‘artifacts leftover from the Industrial Revolution.’ Others contend that the written form is still vital because it puts structure into performance evaluations. Taking the time to write an evaluation signals to employees that you think they’re important. A performance review’s goal shouldn’t be to punish an employee for not meeting expectations but to help the employee and the business grow and succeed.

Keep This in Mind Before Writing a Performance Review

Research has found that performance feedback that only occurs a few times a year is unlikely to be meaningful. Providing ongoing, less formal communication consistently throughout the year, followed by a formal written performance review reflecting what employees have heard throughout the year, can be affirming and motivating.

A Gallup poll shows that when managers provide weekly (vs. annual) feedback, team members are: – 5.2 x more likely to strongly agree that they receive meaningful feedback – 3.2 x more likely to strongly agree they are motivated to do outstanding work – 2.7 x more likely to be engaged at work

Follow these steps to deliver a meaningful performance review:

1. Provide regular feedback throughout the year

Offering feedback and coaching (if necessary) regularly throughout the year will help you establish a solid foundation. Here are some guidelines for giving feedback:

Stick to verbal input most of the time. Sharing information feedback will be less intimidating and make employees more receptive. Don’t make it a big production.

Focus on positive rather than negative feedback. Think of the adage: you can catch more flies with honey than vinegar. This is not to say that you have to lavish praise for every effort; however, positive reinforcement is much more effective at encouraging employees to do good work.

Offer training rather than delivering after-the-fact critiquing. There’s always room to learn and grow, no matter what level of experience or how many years an employee’s been on the job.

2. Ask the employee to write a self-evaluation

Much like the formal review concept, the idea of employee self-evaluations has also received its share of criticism. A Harvard Business Review article advocates ditching an official form and instead, asking employees to prepare an informal list of their most important accomplishments and achievements. Again, others prefer having employees submit a formal evaluation (example here) that follows a form. The benefits of self-evaluation can be powerful by:

– Increasing an employee’s self-awareness – Reminding the reviewer of an employee’s accomplishments – Instilling self-confidence in an employee

3. Write & deliver the employee performance review

Using a performance review template (or developing your own, an example is here to get you started) and taking the employee’s self-assessment into account, complete your own review of the employee. While it’s advantageous to emphasize the positives, you should also be honest. A few tips: – Include a mix of numeric and qualitative feedback. (In the example linked to above, there is both a numerical rating of virtues such as “taking initiative” and a comments section to add color) – Don’t make it too long. Don’t view the performance review as a laundry list. Instead, focus on a few key areas where you think the employee has the most to celebrate and the most opportunity for improvement. – Deliver the review in person (or video call if in person isn’t possible). Don’t just email the review to your employee, instead schedule some time to review it together with them. This allows you to explain the context behind your thoughts and allows them to ask clarifying questions.

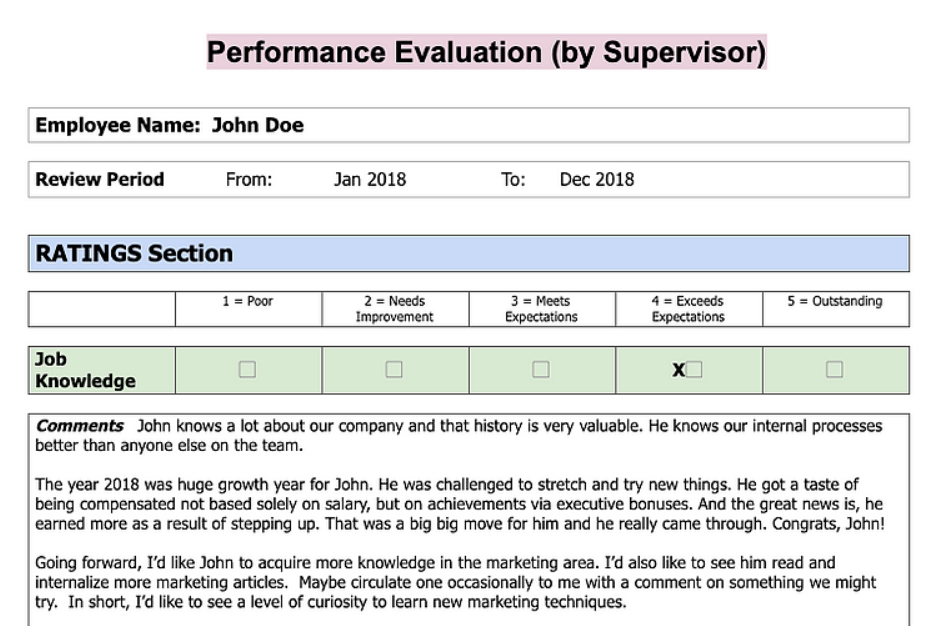

Click to Open Template of Example Supervisor Evaluation

Performance reviews can, and should, be a positive and beneficial experience for everyone if done correctly. They can also be a powerful tool that can enhance your relationship with employees and improve your organization’s performance.

Source: EO Global Octane Blog

Using Digital Marketing to Rebound from COVID-19

Cautious optimism surrounding the recent approval of the coronavirus vaccine may have us hoping for the best, but as the virus continues to rage, it’s still not business as usual. Maybe it never will be. We’ve had to pivot, to flex our agile muscles, to embrace digital marketing as never before.

Digital marketing offers substantial benefits, especially when it seems much of the world is exclusively operating digitally. It eliminates the need for face-to-face interaction (a key to stemming the virus’s spread), but it’s also measurable and easily adjustable. Analytics enables you to see your return on investment and quickly change anything that’s not working.

Digital Marketing Strategies and Tactics to Rebound from COVID-19

While many brands have opted to play it safe for fear of tarnishing their reputation—marketing experts suggest that now is not the time to sit back and hope for the best. Brands and marketers need to focus on offering short-term communication and innovation to secure long-term success in this unpredictable period. It’s a time to reinvent, inspire, and provide a viable solution to a very pressing problem.

Here are some examples of successful digital marketing campaigns to get you inspired:

Guinness Beer: St. Patrick’s Day Video

Guinness created a unique St. Patrick’s day video focused on a message that brings people together, offered a clear value, and let their consumers know that they were there for them in a campaign that will serve them well into the future.

The video uses an uplifting, inspirational tone coupled with a theme of communal care and solidarity to striking an emotional chord while demonstrating value and humanizing the brand in uncertain times.

Guinness yielded excellent results from its Covid-19 marketing campaign, which was original, relevant, and on-brand. The spot performed well above the US norm for brand favourability (49 percent).

Many people wanted to share the ad to be part of the Zeitgeist, with 21percent saying they would share it because the content defined the spirit and mood of the time.

Getty Museum: Creative Social Media

The pandemic closed museums, but the Getty Museum jumped at the opportunity to promote its brand through social media. Launching the ‘Getty Museum Challenge,’ the museum issued a challenge asking social media users to recreate their favorite artwork using just three objects found around the house.

It was an instant hit, generating tens of thousands of responses across social media platforms and providing well-deserved engagement for the Getty Museum.

Dunkin’: Making the Coffee Break Virtual

Dunkin’ tapped into the growing gratitude people expressed during the pandemic for front-line workers with a way for Americans to help and to show support without having to leave home. It created the DunkinCoffeeBreak.com eCommerce site to give customers a way to show appreciation by sending a virtual coffee break in the form of a Dunkin’ e-gift card. Dunkin’ donated $1 (up to $100,000) for every card purchased at the site to the Dunkin’ Joy in Childhood Foundation emergency funds, specifically for non-profits helping families affected by COVID-19.

The site is driving incremental digital gift card sales and has generated a 300 percent increase in year-over-year gift card sales for specific events.

Chipotle Mexican Grill: Zoom Lunch Sessions

One of the first brands to act once the pandemic began upending daily life, Chipotle Mexican Grill launched Chipotle Together, a series of daily sessions on Zoom. First, bringing 3,000 fans and celebrity guests together over lunch, when they may usually have lunch at a Chipotle restaurant under different circumstances, and later offering it at various times throughout the day.

In just two weeks, the campaign generated 500 million impressions and 100 earned media stories. The strategy demonstrated an excellent way to deliver community to consumers hungry for connection in the early days of the lockdowns.

There is no doubt that this is an unprecedented situation, and it’s a real challenge right now for businesses to know how to adapt their creative strategies. The pandemic has challenged everyone, but it also provides businesses opportunities to grow and thrive like all challenges. Taking advantage of digital marketing is an option that can guide you safely into the future. Learn more about Entrepreneur’s Organization New York, a community of entrepreneurs who are leading their organizations through unprecedented changes, challenges and opportunities just like you.

Source: EO Global Octane Blog

Virtual Team Building Activities For Remote Teams

Even before the pandemic necessitated moving to remote work for thousands of people, it’s been trending upward, growing 173 percent since 2005. Another 2018 study showed that about 70 percent of the entire global workforce telecommutes at least one day a week already.

Research has found that employees who worked from home reported “higher levels of job satisfaction and reduced levels of burnout and psychological stress.” Employees that work from home can often struggle to feel connected with coworkers and the organization. By investing in remote team building activities, you can build happy, engaged, and productive remote teams.

Virtual team building activities can range from silly and straightforward to those that include teaching work competencies under the guise of fun. They can all create solidarity among remote teams.

Mystery & Intrigue

With simple animation and eerie music, virtual games such as Among Us and the virtual version of Codenames provide fun ways to foster team spirit and cooperation. Both games rely on problem-solving skills and a bit of imagination.

Virtual Team Coffee Breaks

A 15-minute “coffee break” each day or once a week, depending on your preference, is a simple way to provide a relaxing environment with team members. The team can gather on a video chat platform for conversations that can be work-related or purely for fun and entertainment, just as if people were sharing a coffee break at the office. Take it up a notch by sending team members a company coffee mug.

Virtual Escape Rooms

This activity lets teams play together while providing a great problem-solving activity. You can split into smaller teams and turn it into a friendly competition. Virtual escape rooms can be done in one sitting or a prescribed amount of time, such as a week.

Articulate

If you’re looking for a virtual team-building activity that combines brain power and laughter, this may be the game for you. It can be adjusted to take 15 minutes or an hour and requires no special materials.

Instructions: 1) Each person gets a different list of 10 words (e.g., laughing, movie, dog, etc.)

2) Each participant gets one minute to describe as many of their words as possible to everyone else, without saying the actual world. Phrases such as “sounds like” or “starts with” cannot be used.

3) After each participant has a turn, the person who can describe their words to the highest number of players wins.

Read My Lips

This is an easy and quick game to play with your team that mixes stress relief with a bit of critical thinking.

Instructions: 1) One team member mutes their microphone so they can only be seen, not heard. Be sure the other players are not muted so he/she can still hear the others in the meeting.

2) The designated player “says” a phrase. To make it a bit easier, you can select a topic or a theme.

3) Everyone has one to two minutes to guess what the designated player said. Once the phrase is guessed or a player’s time is up, another team member is designated.

Dog, Rice, and Chicken

Creative thinking and problem-solving foster collaboration and is a hallmark of a great team. This game practices lateral thinking and teamwork skills and offers an opportunity to discover how well your team can work together when challenged.

Instructions:

1) One person plays the role of the farmer, and the other team members are the villagers.

2) The farmer has a dilemma: he has a dog, some rice, and a chicken he needs to get across a river to get home, but can only carry one item at a time. He cannot leave the dog alone with the chicken because the dog will most likely eat the chicken, and he cannot leave the chicken alone with the rice because the chicken will eat the rice.

3) The villagers must help the farmer come up with a solution.

4) If your team is large, you can create multiple villager teams; then the winner is the team that comes up with the fastest and the least number of boat trips across the river.

Lunch and Learn Sessions

Lunch and learn sessions are fantastic events that allow your team to learn new skills while having a break from the workday. It can be done as a quick presentation or with a guest speaker who shares career-building skills or helps with personal goals. It is also a great way to provide lunch to your remote team via delivery service. You can make this a quarterly event and change the topic each time.

Guided Meditation

During an otherwise busy day, ten quiet minutes can be an effective way to bring people together and build strong remote teams. You can achieve these results with a guided meditation session.

Find a guided meditation exercise online or contact an expert to guide the group. Consider sending employees a care package with scented oils and candles beforehand.

Research has shown that remote team activities have myriad benefits—boosting team morale, increasing productivity, encouraging creativity—all good for business!

Source: EO Global Octane Blog

Behavioral Questions to Ask in an Interview (And What to Look For)

Interviewing is hard. Most job applicants are going to make an effort to shine, and it’s hard to tell if the polish is only surface deep. Some candidates are glib and able to give polished answers to standard interview questions. Behavior-based interview questions provide a way for interviewers to delve into how candidates handled past situations. That information can inform their ability to perform in a position. These types of questions often begin with the phrase, “Tell me about a time when you…”

The Benefits of Behavioral Interviews

Behavioral interviewing is based on the premise that the best predictor of future performance is past performance and can:

Save Money

Hiring an employee is a significant investment, and a bad decision can cost your business a lot of money. It can also have a long-term effect on a company because below-average employees can lead to disappointed clients and drag down team productivity.

Provide a better understanding of the candidate

The behavior interview format lets an interviewer gain a more in-depth picture of a candidate in ways that can help determine if they are a good fit for your organization. It’s a way to measure soft skills, personality, problem solving, and work ethic.

Help predict the employees’ future behavior

Questions like “give me an example of” or “what will you do if” can help interviewers understand if the candidate would approach common situations in a given role in the way the company would want.

Are Behavioral Interview Questions Effective?

Behavioral interview questions can be very effective, but they need to be framed correctly. One important component, as explained in a Forbes article, is how the questions are phrased. The idea is that often typical behavioral interview questions give away the right answers, cueing candidates to share success stories and avoiding failure examples.

For example:

ORIGINAL: Tell me about a time when you adapted to a difficult situation and how you did it.

Expressing the question using this language makes it very clear to the candidate that they are supposed to share a success story about adapting, balancing, persuading, etc.

CORRECTED: Tell me about a time when you faced a difficult situation.

Rewording the question allows a candidate to share success stories that provide details, context, evidence of critical thinking, and much more.

What to Look For When Asking Behavioral Questions

The process enables you to more accurately determine what qualities and behaviors you are looking for in a candidate that aligns with your organization’s core competencies.

How does the candidate answer the question?

The candidate should provide the answer in the form of a short story, not just list the tasks and activities they accomplished but also what strategies and tactics they used to accomplish them. Encourage candidates to provide specific details about their actions.

What was the candidate’s individual response to the challenge?

Teamwork is good, but you’re trying to ascertain what the candidate’s exact role was in this instance. If there was a team, how did they personally contribute?

What is the candidate’s body language like during the interview?

While an interview can account for a certain level of nervousness, if the candidate is overly uncomfortable or fidgeting, it may indicate that they are not being fully transparent. If this is the case, feel free to ask follow up questions to more fully explore the past experience.

Sample Behavioral Interview Questions

When using behavior-based interviewing, every candidate must be asked the same questions to assess them fairly.

Example questions include:

– Tell me about a difficult work challenge you’ve had.

– Have you ever been in an ethically questionable business situation?

– Have you ever had a project that had to change drastically while it was in progress?

– Talk about a time when you’ve had to sell an idea to your colleagues.

– Tell me about a major setback you’ve had.

– Talk about a time where you had to make an important decision quickly.

– Have you ever had a deadline you were not able to meet?

– Talk about a time when you had to adapt to significant changes at work.

– Have you ever had to convince your team to do a job they were reluctant to do?

– How have you dealt with an angry or upset customer?

Are additional probing questions needed?

If a candidate’s answers are vague, ambiguous, evasive, or don’t fully address the question, ask follow-up questions triggered by the response. Suggestions include: I’m not quite sure I understood. Could you please tell me more about that? I’m not sure what you mean by ___. Could you give me some examples? You mentioned ____. Could you tell me more about that? What stands out in your mind about that? Can you give me an example of ___? You just told me about ___; I’d also like to know about . . .

Behavior-based interviewing isn’t perfect, and it’s not a panacea for complex recruitment and retention challenges. Still, it is a tried and true methodology that’s used by some of the world’s most successful companies.

Source: EO Global Octane Blog

How To Get An SBA Loan for Your Company

It’s been a challenging year for small businesses. The need for extra cash may be more pressing than before as many businesses dig their way out of the COVID-19 economic crisis. Many companies, regardless of size, use borrowed capital to fuel growth and fund other initiatives. Long-term, low-interest financing makes SBA loans some of the most affordable business loans on the market, and the process of getting an SBA loan can be lengthy and involved (but worth it). Follow these steps to make the process more manageable:

1. Determine your eligibility for an SBA loan.

First and foremost, make sure you’re eligible for an SBA loan. Depending on the program you choose, there are specific guidelines, and some are more flexible than others; however, the general requirements include that your business:

Be a registered for-profit business

Be located and operating in the U.S.

Meet the SBA definition of a small business

Has an owner that has invested time and money into the business

Has no past delinquencies or defaults on government debts

2. Choose your SBA loan program.

The next step in getting an SBA loan is choosing your specific loan program. The SBA offers various loan programs, and each program has unique requirements, terms, loan amounts, typical interest rates, purposes, etc. It’s important to consider all of the options and determine which SBA loan program is best for your business. A few of the most popular options include:

SBA 7 (a) Loans

A few different SBA 7 (a) loans offered by SBA lending partners (typically banks) are available, with loan amounts up to five million dollars. The terms can be as long as 25 years, with interest rates ranging from eight to thirteen percent, and can be used for any business purpose.

SBA 504/CDC Loans

Sometimes referred to as SBA real estate loans, SBA 504/CDC loans are used exclusively for major fixed asset purchases, such as large equipment or real estate purchases. The distinctive structure—a participating Certified Development Company (CDC) in your area provides 40 percent of the loan amount, an SBA lender provides 50 percent, and you offer the remaining 10 percent. The loans can extend up to five and a half million, with interest rates falling between five to six percent and terms up to 25 years.

SBA Microloans

The SBA Microloan program is designed to offer small businesses affordable capital in smaller amounts—with a maximum loan amount of $50,000. The maximum term available is six years, with interest rates falling between eight and thirteen percent. Because the eligibility criteria for this program is more flexible, it can be an excellent option for start-up businesses.

3. Find the right SBA lender.

The right SBA lender for you will largely depend on the loan program you’ve chosen. Check with your local bank or the bank you use for your business and ask them what kind of SBA loans they offer. You can also connect to an SBA lender using the SBA’s website.

4. Gather the information and documentation needed to apply.

The SBA loan application requires significant information and documentation—some of which will depend on your lender and loan program. Overall, make sure that you gather the following information and documents for your SBA loan application:

Basic business information

Basic personal and background information for you, as well as any other business owners

Loan request letter detailing the amount you’re asking for and how you plan to use the funds

Business plan

Personal and business tax returns

Personal and business financial statements—including a balance sheet, profit and loss statement, bank statements, and cash flow statement for the business

Existing business debt schedule, if applicable

Legal documents like business licenses, leases, and contracts

Any SBA loan requirements that are unique to your program

5. Complete your application.

Once you’ve gathered all of the information and documentation you need, the next step to getting an SBA loan is completing the application. The specific document will depend on the lender. Some lenders may offer online-based applications, whereas others will require that you complete a paper form.

6. Close your loan and receive funds.

Congratulations! The final step is working with your SBA lender to close the loan.

These are the basic steps to getting an SBA loan. Although the process may not be particularly fast or simple, the time and effort necessary to get an SBA loan are well worth it.

The EO global entrepreneurial network offers a suite of connections, tools, and resources to help you succeed in your entrepreneurial journey. Explore the forums, events, mentoring, and coaching benefits EO members receive to enhance your business.

Source: EO Global Octane Blog

What to Ask Before Buying a Franchise

Article by:

Akhil Shahani

EO Bombay

Akhil Shahani is the director of The Shahani Group.

E-mail Akhil at akhil@shahanigroup.com.

If you’re considering buying your own franchise, you probably have a million questions running around in your mind; questions that can make a difference in the success or failure of your business goals. To give you control during the decision making process, here is a checklist of 20 questions that I share with clients before they make the leap into franchising:

How long has the company been in existence before it started franchising? Was it specifically set up to franchise?

What is the company’s financial position? You should check accounts for at least the past three years. Can you get trade or bank references?

Can the franchiser show you any figures or net profits of one or more of its existing franchisees, and can you personally check the figures with the franchisees themselves?

What are the criteria to be selected as a franchisee?

As a franchisee, what are your obligations? Are there any operational restrictions on pricing or use of suppliers?

What is the nature and extent of the rights that will be granted to you?

How many franchised units are currently in operation? Are there also companyowned units in operation?

Does the agreement have a termination clause; if yes, what will it cost you?Can you sell your franchise?

Does the franchiser have a reputation for honesty and fair dealing among its franchisees?

What kind of assistance will the franchiser provide? Will it involve management and employee-training programs, advertising campaigns, credit and merchandising ideas?

Does your region have a law regulating the sale of franchises, and has the franchiser complied with that law?

How much equity capital will you need upfront to purchase the franchise and operate it until the profits start rolling in? Will there be sufficient profit left once you’ve paid all of your expenses?

What are the initial and ongoing fees? Are there any other hidden costs?

Will you get the exclusive rights to the territory for the length of the franchise period, or can the franchiser sell a second franchise in your territory? If the answer to this question is “yes,” what is your protection against the second franchising company?

Have any franchised units failed during the past 12 months? If so, what were the reasons?

Is the franchiser a member of a reputable franchise association? Have they ever been refused membership?

In the event of a dispute between the franchiser and the franchisee, how will it be dealt with?

What is the procedure for terminating the agreement, and what are the consequences of doing so?

How is the communication between the franchiser and franchisees? Is it possible to talk freely to existing franchisees?

What are the franchiser’s long-term plans for the future of the business?

Though business surveys show that fewer than 20 percent of all franchised businesses fail compared to the 60-80 percent failure rate for all new businesses started each year, it’s important that you investigate a franchise opportunity thoroughly. The checklist above will serve as the starting point nof your franchising journey. If you can get the answers to each of these questions, and those answers satisfy you, then you’re on your way to becoming a proud franchise owner.

Source: EO Global Octane Blog

Buying a Business? Start Here.

Buying an established business has its advantages. For example, when you buy a business, you take over an organization that’s typically already generating revenues. There’s also usually a customer base, an established business reputation and existing operational procedures. However, just like any kind of investment, there are risks as well. It is important to do the necessary research and understand the factors that may affect the success or failure of your venture.

We explore three of the most important things to consider before buying an existing business.

1. Is the Business Right for You?

Buying a business that’s not right for your needs and interests may cost you more time, energy and money than you think. To prevent this, gather all the necessary information about the business to help you determine if you can commit to it.

Start by reflecting on your intention of buying the business. Do you plan to get involved actively and manage the business yourself or is this a passive investment? Be honest and clear in your intentions as you assess potential businesses and employees.

Second, you must understand how the organization operates—and be interested in those operations. This doesn’t mean you need to be passionate about the product or industry. Rather, it should at least be something that holds your attention, you have experience with and you would be happy to devote your time and energy.

2. Is the Business a Good Investment?

Once you have established that the business is right for you, the next thing to consider is whether you can make money from the business. While it may seem obvious, confirming profitability requires you dig thoroughly and find detailed answers.

Find out the reasons why the business is for sale. If the business is in bad shape and hasn’t been performing well financially, then ask yourself, “Am I ready and qualified to take on this considerable project?”

It is best to determine the business’s average gross annual revenue and net profits (if any) for the previous two years. If it meets your financial expectations, the next thing you’ll want to do is determine its fair market value.

Make sure you determine the right value of the business using several factors, including the average revenue, expenses, assets, liabilities and future projected earnings. You may also need to consider its market share and clientele, as this can affect future earnings. Through this information, you will likely be able to evaluate the time you need to invest as well as the value of your potential ROI.

Further, check out the business’s reputation. Do they have an established customer base and market share? Are the employees experienced and trustworthy? Are the products and services of good quality and value? How well known is the business in the market? These questions will help you determine whether or not the business is worth buying.

3. Can You Afford the Purchase?

You have established that the business is interesting, valuable and has a potential to become a good investment. The next thing? Find out whether you have the funds to purchase the business outright or if you need to finance the purchase, including being able to cover other operating expenses/unforeseen costs associated with the business.

Aside from exhausting your savings and borrowing money from friends or family, you have the option to take a loan for buying a business. A few of the financing options include SBA loans, ROBS , conventional bank loans and HELOCs. Some of these require a 10 percent to 30 percent down payment, collateral and a credit score of ideally 600 or more.

Further, you have to consider other things when trying to buy a business. Are you going to pay yourself a salary for managing the business? Is it a failing business you need to turn around and invest more cash into over time? Or is it just a passive cash flow investment where you do nothing and expect to receive a return?

Being able to afford a business isn’t just about the initial financing. Consider the expected cash flow and financial demands over time. After all, there might be unforeseen and costly strings attached to buying and owning a business.

Bottom Line

Buying an existing business that’s in line with your interest and has a potential for further growth is a good investment. However, there are strings attached. Other than putting up your own money and securing financing to help you with the purchase and other expenses, you also need to ensure that you’re making the right decision based on your needs.

Source: EO Global Octane Blog

Online Tools for Better Business

Despite the economic stranglehold impacting the business world, there are a lot of inexpensive online resources that can help you set your business up for success. Here are a few of the best Web sites I’ve come across, and what they have to offer:

99designs.com

The appearance of your business matters, especially when you’re trying to establish yourself in the marketplace. The right designer can be integral to perfecting your corporate image. 99designs takes the risk out of this process by using your business brief to set up a design contest, whereby designers compete to make the best design for your needs. Just know what you want designed and how much you’re prepared to pay for it. You choose your favorite design and pay the agreed fee, and then the designer sends you his completed design and copyright to the original artwork.

Basecamphq.com

This is a project management system that runs online. It’s collaborative, and while it’s mainly recognized by Web developers as a key tool, it serves as a solid project management system for any company. It’s a simple system to use, and it provides file storage, as well as a way of connecting with clients who may not be as good at online communication as you are. This is an excellent, easy-to-adopt project management tool, and it prevents new businesses from having to invest in their own project management system at great cost.

Venda.com

Venda offers technology platform needs and provides ongoing business services and consultation. Its focus is on e-Commerce— they have a team dedicated to finding simple, speedy solutions to e-Commerce problems. After implementation of the technology, there is a support and service infrastructure of more than 200 people who will work with you to boost your return on investment. There is a guaranteed 24/7 help desk, too. What’s more, Venda offers a simple, cost-predictable monthly payment model, so you’re not surprised with hidden costs.

SubHub.com

SubHub makes it easy for anyone to build a moneymaking Web site. It’s turnkey, hosted and managed platform incorporates powerful, yet easy-to-use, content management with a range of income-generating options. These include subscription and membership site functionalities, but also advertising capabilities, affiliate marketing tools and an online store. By making it simple to make money from online content, SubHub gives clients greater freedom and the opportunity to profit from their expertise.

Source: EO Global Octane Blog

What to do When Generations Clash

Article by:

Jonathan Davis

EO Austin

I’ve just returned from the EO President’s Meeting in Dallas, Texas, USA, where one of the biggest topics was the significance of delivering value to members in order to ensure retention. Like most organizations and companies, acquiring a new member (or customer) is very expensive and time-consuming. It seems obvious that, once you’ve acquired them, retaining members should be a heavy area of focus for any leadership team.

The discussion eventually shifted to the age of our members and the risks/rewards of eliminating the ceiling that is currently placed on new members. When EO was started more than 20 years ago, it was created for entrepreneurs who were under the age of 40. When I joined five years ago, the average age of a member was about 37. Today, the average age of a member is 41. To put it more simply : Every year that I’ve been part of this organization, the average age has gone up by one year, and a new generation of entrepreneurs are ushered in. This is indicative of our entire population, and the management of these people is a major challenge for companies everywhere. As businesses continue to grow and mature, entrepreneurs are worried about the retention of their employees, as well as the age of their teams.

Author Jason Dorsey, widely known by the business word as the “GenY Guy,” has some incredible data points regarding generational employees. Here are a few:

For the first time ever, the world has four generations working together in the same workplace (GenY, GenX, Baby Boomers and “the Mature” Generation)

The average life expectancy of a Baby Boomer is about 78, while the “retirement age” is still 65

GenY employees are the first generation in history that will likely need to work for 65 years (that’s retirement at 87-90 years old)

On top of these points, here are several scary ones for business leaders:

While Baby Boomers are finally comfortable with e-mail and are actively learning about Facebook, GenY’ers aren’t using those mediums as much because they’re cumbersome and/or they’re no longer “cool.”

GenY’ers believe that long-term tenure in a role is 13 months. Meanwhile, Baby Boomers want to give these employees reviews once a year.

GenY’ers aren’t really motivated by money as a “carrot” the way previous generations have been. Why? Because their parents (those same Boomers) have given them a credit card to pay for things like gas, groceries, vacations, etc.

Driving retention, loyalty and performance from the GenY population is becoming a real challenge for businesses. This is a generation that is affordable, hard-working and passionate about their work, but they can’t be relied on to work diligently from 8 a.m. to 6 p.m. every day. They aren’t interested in sitting in meetings to talk about the next meeting, and they’re no longer “tech savvy.” Rather, Jason calls them “tech dependent,” because they don’t have any idea how their smart phone works— they just know they can’t live without it.

What are you supposed to do as a business leader when you wake up and realize that the future of your organization depends on leveraging this new population of workers; these people that you can’t relate to? Here are a few suggestions Jason offers:

Accept that while work/life balance is something that Baby Boomers dream about and GenX’ers talk about, GenY lives it. You won’t be able to keep them around if you expect them to sacrifice their friendships and social time. Create a workplace that inspires them and encourages both hard work in short spurts and downtime.

Let GenY’ers work in teams as often as possible. This is a generation that was raised playing soccer, baseball and other team sports. If you’re asking them to work solo and independently without praise, they’re not going to stay engaged.

Start with the outcome and then work backwards to talk about the steps. This is counter-intuitive to the way most people are used to teaching, but by starting with the big picture and driving universal awareness of the challenges, GenY’ers will embrace the challenge and buy in to the goals instead of zoning out.

Give employee reviews all the time— 10-minute check-ins every week or two are significantly more powerful than an annual review. Let this new generation know what they are doing right, give them praise, offer corrective actions and make minor adjustments all the time instead of hoping they’ll be around for their first annual review.

These and other tips are in Jason Dorsey’s new book, Y-Size Your Business: How Gen Y Employees Can Save You Money and Grow Your Business, which I recommend to all of my EO peers. Jason offers invaluable insights into how to handle new generations of employees, and he’s taught me a lot about how to set my business up for future success. As an entrepreneur, this is one book I can count on.

Source: EO Global Octane Blog

5 Self-Employed Tax Rules You Want to Know Now

Written for EO by Jessica Thiefels, social media coach and organic marketing consultant.

According to Pew Research, close to 15 million Americans are self-employed. Filing your taxes when you’re self-employed means you’re having to deal with a range of new tax rules and regulations that you’ve never dealt with for personal taxes.

To ensure you understand what you have to do, consider turning to a CPA. This person will walk you through what you should and shouldn’t do. You’ll likely see your CPA a few times throughout the year as well to make sure your income is on track and that there are no surprises come tax time.

Even if have an expert to guide you, it’s important to know what’s expected of you for taxes as a self-employed person. Here are just some of the tax rules that may be new to you and are important to know.

1099s

If you’ve paid out more than US$600 to a service provider or received more than US$600 for providing services, you’ll give and get 1099-MISC for each business or person. As someone who’s self-employed, you’ll need to send a 1099 to anyone who you’ve paid more than US$600—think, a freelance writer or web designer. If you use accounting software like Quickbooks, you can do this automatically once you have a W-9 from the person. The companies who owe you a 1099 will send it automatically—there’s no need for you to request it.

Note that you must have the 1099s sent out by January 31, according to Micah Fraim’s Freelance Tax Guide, so put it on your calendar to avoid a penalty.

Quarterly Tax Payments

Quarterly tax payments are paid by self-employed individuals who plan to earn more than $1,000 in the tax year. The IRS requires you to pay taxes as you earn income throughout the year and when you work for a company, the amount of money withheld from your paycheck covers this. As a self-employed individual however, you have to make quarterly tax payments to cover these taxes throughout the year yourself.

It’s important that you pay enough quarterly taxes and that each payment is made on time. The IRS explains, “If you don’t pay enough tax through withholding and estimated tax payments, you may be charged a penalty. You also may be charged a penalty if your estimated tax payments are late, even if you are due a refund when you file your tax return.”

This is another reason why it’s important to work with a financial professional or CPA. They will ensure that you know exact payment dates along with the correct estimated totals.

Expense Tracking

Keep a receipt for anything that you buy for your business, from stamps for mailing checks to your invoicing software and passes to industry conferences. These expenses are deductible and reduce the overall total dollar amount that you owe taxes on. According to the same tax guide from Micah Fraim, some of the common tax deductions are:

Office supplies and equipment

Travel and meals

Internet

Phone

Advertising

Health insurance premiums

Professional development

Bank fees

Software costs

Keep track of each expense so they can be factored into your taxes at the end of the year. There are a variety of apps you can use for this, and most accounting software allows you to do it as well.

Check out EO member and CPA Greg Crabtree’s perspective on paying taxes.

Home Office Deduction

If you’re a contractor or freelancer, there’s a good chance you work from a home office. If you have an office area designated as a working space, you’re allowed to deduct a percentage of the cost of that space, as well as a percentage of utilities used.

Amy Bergen, writer for Money Under 30, explains: “The home office also needs to be the principal or primary place of your business—your base. If you occasionally work or have meetings elsewhere, you can take the deduction as long as you use the home office consistently.”

There are a few methods for taking advantage of this deduction. Work with your financial advisor to choose the best one for you.

Self-Employment Tax

This tax covers your contribution to Medicare and Social Security as a self-employed individual. This is normally taken out of your paycheck, but since you’re no longer a W-2 employee, you’re now responsible for this yourself. As such, this cost is factored into your quarterly tax payments.

Intuit explains:

“When you’re self-employed, you are paid the full amount you earn. Nothing is deducted from your check for Social Security and Medicare taxes. Instead, you make estimated tax payments during the year to pay your SE tax and your income tax. If you don’t make estimated tax payments, then you pay these taxes when you file your return.”

The tax rate for the self-employment tax is 15.3 percent, with 12.4 percent for Social Security and 2.9 percent for Medicare.

Know Your Tax Obligations

It’s important that you know your tax obligations as a self-employed individual to avoid fees or penalties. Working with a financial professional ensures that you’re not missing important payments and are totally prepared come tax season. Get familiar with your responsibilities as you step into the world of self-employment to start your tax year on the right foot.

Source: EO Global Octane Blog

How Healthy Are Your Books? Here are Six Questions to Unlock Answers.

I visited a friend the other day who runs a well-organized business and keeps a meticulous office. Every desk is tidy, every scrap of paper is in a binder or folder, and everything is labeled and filed alphabetically and by year.

And yet, despite all this organization, he never quite feels in control of his business. Sure, the organization gives him good control over the workflow and processes, but he could not answer the basic business questions he had about cash flow, profitability and pricing. Despite all the binders and folders, he could not get reliable answers out of his accounting system and so could not make good decisions about the future of the company.

I believe all good answers start with good financial statements, so we sat down to take a look at his. Within just a few minutes, we spotted six areas that needed attention. Here’s a quick test to see if these same six areas can help you get better answers to your financial questions – and make better decisions about your company’s future.

Does your balance sheet have negative accounts?

A balance sheet is set up so that accounts are always positive (with just two exceptions: Depreciation and Owner Distributions). It’s understandable that your bank account should never show up in the negative, but it is less intuitive that debts (credit cards, loans, etc.) should also be a positive value on the balance sheet. All assets, liabilities and equity accounts should be positive numbers. If they’re not, it’s likely that transactions are being booked incorrectly.Is it true?

Since it shows bank account balances that should agree with a monthly bank statement, a balance sheet is easy to fact-check. But not all accounts have objective statements, so look closely. Tax Liability accounts are the most common place to find mistakes (and fraud). See if you’re booking taxes and tax payments correctly, then look into loan balances, leases and credit card accounts. (Remember, a negative balance here means that you have over-paid a loan!)Does the income statement show negative values?

Like the balance sheet, a properly set up income statement should have all positive values. If values are negative, it probably means you have an expense account in an income section, or vice-versa. That’s fine if it’s on purpose, but otherwise, you’ve got something backwards.Are variable costs hiding in the xxpense section?

The most important part of an Income Statement is the Cost of Goods Sold (also called COGS or Cost of Sales), which helps you determine Gross Margin and thus, to set more accurate pricing. This section should capture all variable costs. If you have costs like Wages (of your revenue-producing workers), credit card processing fees, shipping, or sales taxes hiding in your Expenses category, you are not properly capturing your true cost of sales.Are payroll expenses properly broken out?